Disclosure: This post may contain affiliate links. If you click one of these links and make a purchase, I may earn a commission at no additional cost to you. As always, I only recommend products and services I truly believe in.

AI Investment Strategy: A Japanese Engineer’s Deep Dive on US Stocks

In my last AI Investment Diary entry, I shared that I began applying the small-cap discovery framework I built for the Japanese market to the US market.

However, this challenge is more than just changing the analysis target from “Japan” to “America.” It means stepping onto a new field with entirely different rules. That’s because the common sense of the Japanese market doesn’t apply to the US market, considered the most “efficient” in the world.

Today, I’ll explain the intellectual backstage of my **AI Investment Strategy**, detailing how my AI analyzes these differences and adapts its approach.

Part 1: The Decisive Differences Between US and Japanese Markets

The success of our AI strategy in Japan was partly due to the market’s structural “inefficiencies.” But as the Efficient Market Hypothesis suggests, the US market is a different beast.

- The Wall of Market Efficiency: The US market has far broader analyst coverage and stricter SEC disclosure rules, meaning there’s far less information asymmetry than in Japan. The very idea of an “overlooked gem” is harder to come by.

- Different Sector Structures: The market’s main players are different. The US is a hotbed of disruptive innovation, constantly producing game-changers in biotechnology, SaaS, and semiconductors.

- Unique Risk Factors: US biotech stocks face the massive hurdle of FDA approval, while semiconductor stocks are constantly exposed to US-China geopolitical risks. These are complex risks that can’t be measured by financial analysis alone.

This different environment meant the role I require from my AI in my **AI investment strategy** had to change fundamentally.

▼ See the AI’s Thought Process on YouTube ▼

The analysis process I describe in this article is powered by tools like NotebookLM. By watching the video where I explain my thought process, you can get a real sense of what “collaborating with an AI” actually looks like.

Watch the AI’s Process on YouTubePart 2: The Evolution of AI’s Role: From “Discovery” to “Probabilistic Support”

In the Japanese market, the AI’s primary role was to “discover” overlooked, high-quality companies.

But in the highly efficient US market, that approach isn’t enough. So, I evolved the AI’s role to the following:

The AI’s role is to assess complex risk factors based on data, thereby supporting human “probabilistic reasoning.”

For example, a biotech company’s value hinges on whether its new drug gets approved. An AI can analyze past clinical trial data, approval rates for similar drugs, and other factors to provide an “input” for a more accurate human decision—”the probability of FDA approval for this drug is likely around XX%.”

The AI’s US Small-Cap Analytical Model (Deconstructed)

To perform this advanced analysis, my AI evaluates a more multifaceted and forward-looking set of metrics. I’m revealing the heart of my AI’s strategy by sharing the key categories and nearly all of the 18+ metrics it uses.

| Category | Key Metrics | What the AI is Looking For |

|---|---|---|

| Growth Potential (Top Priority) | Revenue Growth Rate (Actual %) | Recent, real-world growth momentum. |

| Revenue Growth Rate (Est. %) | Forward-looking expectations, critical in the US market. | |

| Pre-tax Profit Growth Rate (%) | The speed of actual profit growth. | |

| Long-Term EPS Growth Rate (Est. %) | The sustainability of future profit growth. | |

| Profitability & Efficiency | Return on Equity (ROE) (%) | The “quality of management” in turning capital into profit. |

| Return on Assets (ROA) (%) | Profitability relative to total assets. | |

| Operating Margin (%) | Core business profitability and pricing power. | |

| Financial Health | Equity Ratio (%) | The stability of the financial foundation supporting high growth. |

| Debt to Equity Ratio (%) | Dependence on borrowed capital. | |

| Current Ratio (%) | Short-term ability to pay its bills. | |

| Valuation | Price to Sales Ratio (PSR) | Valuing future potential, especially for pre-profit tech firms. |

| Forward P/E Ratio | How cheap the stock is relative to future earnings. |

Concrete Examples from My AI’s Analysis:

Through this model, the AI identified promising companies with traits like these:

- A cross-border e-commerce platform growing in a massive B2B market with its own logistics network (extremely low PSR).

- A biotech firm with a patent-protected drug and high profit margins (low Forward P/E).

- A company with superior technology in a specific semiconductor niche, key to the US-China tech race (geopolitical risk).

- A high-growth, high-profit marketplace driving the digital transformation of the massive insurance industry.

▼ Ask the AI About This Article’s Concepts ▼

Have questions like, “How can I apply this model to my own investing?” or “How do you quantify geopolitical risk?” For a limited time, you can ask my AI chatbot, trained on the concepts in this post, your specific questions.

Ask “Aipan-Sensei” AI ChatbotConclusion: Leveling Up to a More Advanced Game of Intellect

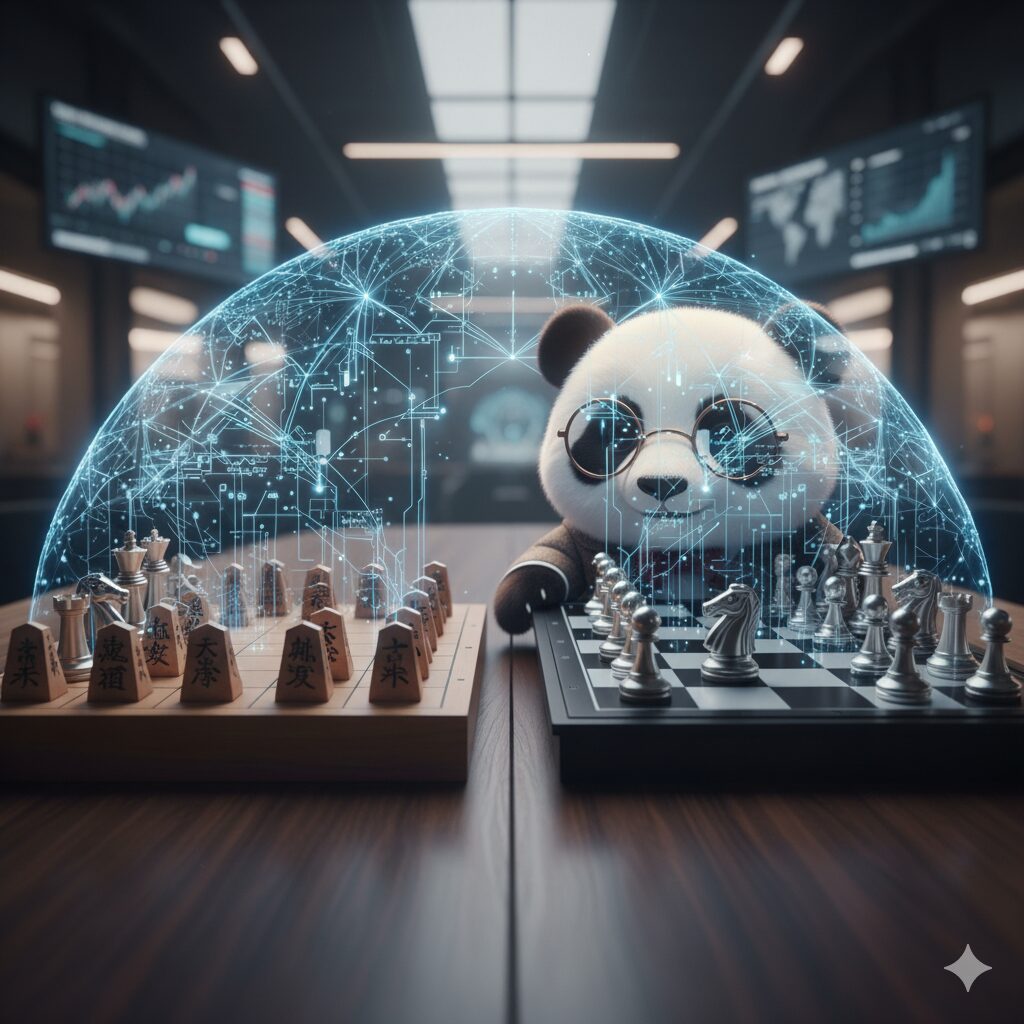

Tackling the Japanese and US stock markets, while both under the umbrella of “small-cap investing,” are fundamentally different games.

- If investing in Japanese stocks is like a “treasure hunt,”

- Then US stock investing is like a “game of chess,” played on an open board where you must calculate the probabilities of your opponent’s (the market’s) next move.

In this advanced game, an AI is no longer just a screening tool. It’s a premier strategic partner that organizes complex information, eliminates cognitive biases, and helps increase the *probability* of making a high-quality decision, even if only by a small margin.

By teaming up with my AI to take on a more challenging and fascinating market, my investment journey has entered a whole new dimension.

The Right Tools for a Global Challenge

This journey into **US stock investing** underscores the need for powerful tools. An effective **AI investment strategy** requires robust software and a brokerage that can handle global markets. For investors looking to execute a similar strategy, having access to an international brokerage account is the first, most critical step.

Platforms like Expedia are essential for planning research trips or attending investor conferences abroad, allowing you to get a real feel for the markets you’re investing in.

Book Your Next Research Trip on Expedia.comDisclaimer

The generative AI utilized in this blog may produce hallucinations (information not based on fact). While every effort is made to ensure the accuracy of the information presented, it is not fully guaranteed. Final investment decisions should be made at your own discretion and risk.

The author is a specialist in generative AI, providing consulting services to businesses, and shares information based on a professional understanding of AI’s characteristics.

Comments